The Global C&I Energy Storage Market: Opportunities, Economics, and Challenges

As energy storage system (ESS) costs continue to decline, the global commercial & industrial (C&I) energy storage market is entering a period of rapid growth. From mature markets in Europe and the U.S. to regions with volatile electricity prices such as Southeast Asia, the Middle East, and Africa, the economic viability of storage systems is improving quickly.

Falling Costs Drive Shorter Payback Periods

In mature markets, EPC costs have dropped 20–35% compared to three years ago, pushing C&I storage payback periods into a 3–6 year range:

- Europe (Germany, Italy, UK, etc.): High electricity prices, network fees, and energy taxes make self-consumption of PV + storage highly cost-effective. Typical payback: 3–4 years.

- U.S.: Incentives like the IRA providing 30%+ tax credits, combined with peak-to-off-peak price arbitrage, yield 4–6 year payback.

- Southeast Asia (Singapore, Philippines, Indonesia): Large electricity price fluctuations and rising peak rates; early-stage virtual power plant projects yield 4–7 year payback.

- Middle East & Africa: Frequent grid instability makes storage critical for peak shaving, backup power, and stable industrial operations. Payback: 5–8 years, but the “must-have” nature is clear.

Electricity Market Structures Fuel Storage Demand

Key global drivers include:

- High prices & large peak-to-off-peak spreads (Europe): Network fees and energy taxes make PV + storage self-consumption economically attractive. Negative pricing further enhances time-shifting benefits.

- Market liberalization & demand response (U.S., Japan): Real-time pricing, ancillary services, and DR programs create additional revenue streams.

- Aging grids & high renewable penetration (Europe, U.S.): Storage stabilizes grid operations and ensures reliability amid high renewable input.

- Grid instability in emerging markets (Africa, Middle East, Southeast Asia): Storage adds production stability and reduces downtime risk.

While these factors are driving rapid growth, they also create complexity and uncertainty for C&I energy storage projects. Understanding these challenges is essential for investors, developers, and operators looking to succeed in a dynamic global market.

10 Key Challenges in Global C&I Energy Storage

- Uncertain electricity pricing mechanisms — long-term profitability is affected by evolving tariff structures.

- Fragmented regulations and safety standards — fire codes, certifications, and installation requirements vary globally.

- Unpredictable load profiles — end-user energy consumption patterns are volatile.

- Limited long-term field validation — many systems lack multi-year operational experience.

- Gaps between cell specs and system behavior — thermal management and BMS integration impact system performance.

- Low asset liquidity — storage assets are difficult to trade or transfer compared to solar.

- Rising non-technical costs — safety upgrades, permitting, and insurance increase project costs.

- Mixed solution quality in the market — inexperienced integrators can cause inconsistent outcomes.

- Limited transparency in financing and data — data collection and standardization challenges hinder investment.

- Limited economics for some PV+Storage scenarios — self-consumption may reduce storage utilization, limiting profitability.

10 Major Trends Driving the Industry Forward

- Higher industry thresholds — safety, reliability, and compliance standards favor professional integrators.

- Service-driven competition — EMS software, AI optimization, and smart O&M create differentiation.

- Increase in self-invested storage by end users — DR, real-time pricing, and capacity markets encourage direct investment.

- Longer system lifetimes — 10–15 years becomes the benchmark, enhancing ROI.

- Market-specific product differentiation — tailored solutions for region, load, and grid conditions.

- Improving project economics — declining installation costs and optimized operations increase returns.

- Rise of Virtual Power Plants (VPPs) — aggregating distributed resources unlocks additional value.

- Higher storage penetration in industrial PV sites — combining PV and storage improves self-consumption and cost control.

- Digital & intelligent O&M — predictive analytics and real-time monitoring become standard.

- Innovative financing models — PPA, leasing, ESG capital, and asset-backed financing reduce entry barriers.

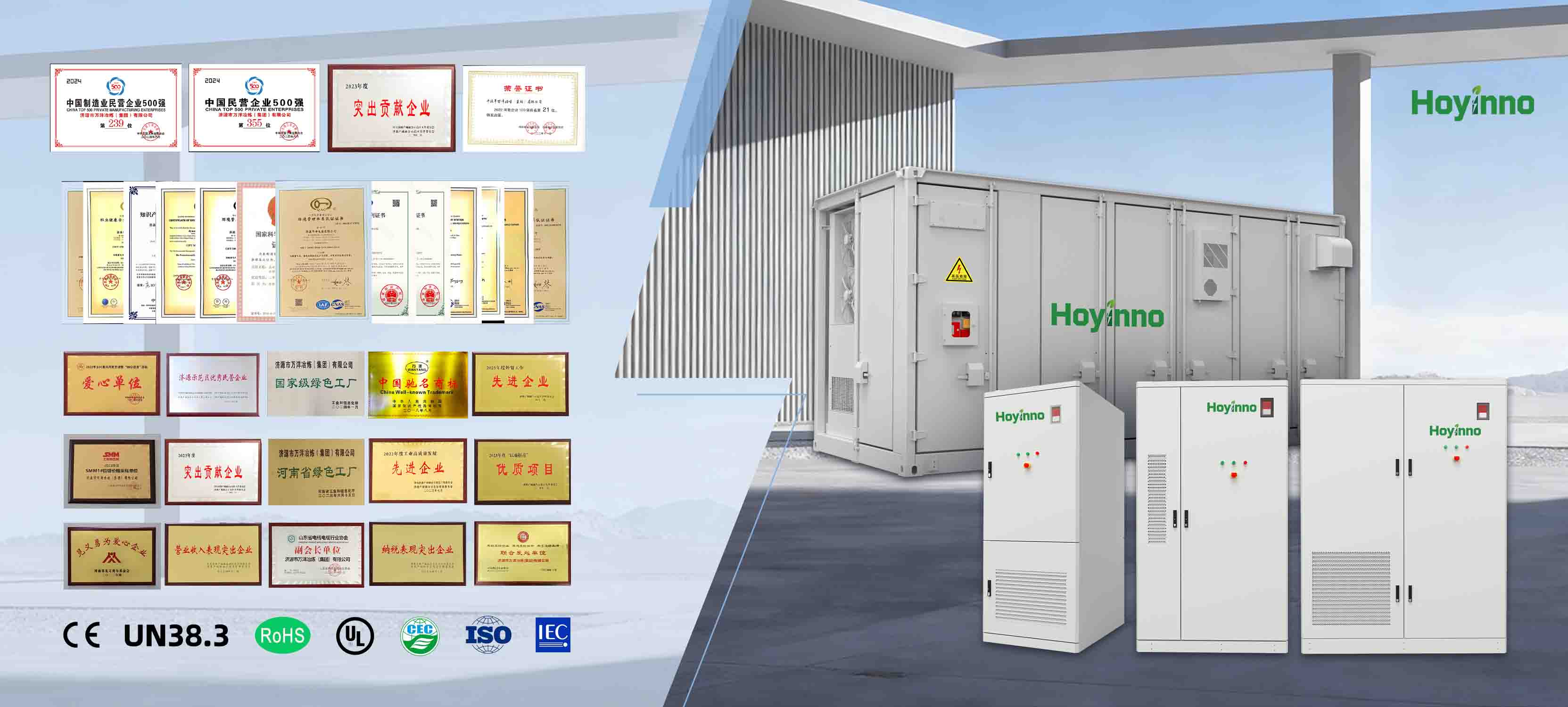

Hoyinno’s Commitment Amid Challenges and Opportunities

In a market full of rapid change, Hoyinno (HonPower Energy) stands out by maintaining professionalism, reliability, and long-term partnerships.

We focus on what matters most:

- Delivering safe, high-quality energy storage systems built for real-world performance

- Engineering customized solutions for every region, grid condition, and use case

- Supporting our partners with transparent, technical, and dependable service

- Offering professional engineering expertise from design to commissioning

As the global energy transition accelerates, Hoyinno continues to contribute strength to the market — helping businesses, industries, and communities build stable, efficient, and future-ready energy systems.

Your challenges are our mission.

Your vision, our engineering.

Welcome to contact us to customize your dedicated energy storage solution.

Home

Home

Energy Storage Industry Risks: Is Rapid Growth Sacrificing Quality?

Energy Storage Industry Risks: Is Rapid Growth Sacrificing Quality?

Address: A401, Junxu Junchuang Park, 03A Qingyi Road, Nanhai District, Foshan City, Guangdong Province, China

Address: A401, Junxu Junchuang Park, 03A Qingyi Road, Nanhai District, Foshan City, Guangdong Province, China